Iнтернет-казино Pin Up UA - офіційний сайт Пін-Ап

Пін Ап – сучасний ігровий сервіс, який щодня приваблює тисячі клієнтів з України. Головна перевага грального закладу полягає у величезній кількості сертифікованого азартного софта, представленому кращими розробниками. Ігровий клуб має попит серед українських користувачів. Відкрити рахунок в закладі можуть користувачі за умови досягнення 21-річного віку. Адміністрація казино Пін Ап пропонує своїм клієнтам вигідні програми лояльності, широкий ігровий асортимент і прозорі умови гри.

Пін Ап Казино Онлайн

Заклад Pin Up одним із перших в Україні отримав ліцензію на свою діяльність. Сервіс закладу доступний клієнтам російською та українською мовами. Відкрити рахунок можна в гривнях.

Найважливіша перевага грального закладу – орієнтація на українську аудиторію. У casino передбачена можливість здійснювати ставки українськими гривнями, а також поповнювати баланс з популярних в Україні платіжних систем. Сервіс компанії не блокується на території країни, що дозволяє клієнтам клубу насолоджуватися азартних софтом без використання стороннього програмного забезпечення. Щоб приступити до гри в казино, досить просто перейти на його офіційний сайт.

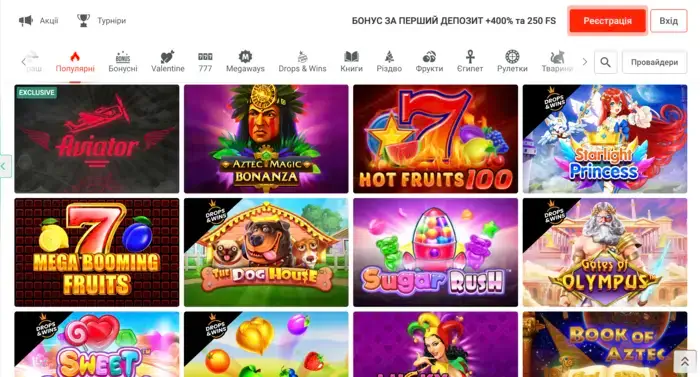

Ігрові автомати (слоти) в онлайн казино Pin Ap

ТОП ігор тижня

Найпопулярніша гра – Aviator

Cash Pig

Lucky Joker 100

Fruit Million FS FS FS FS FS FS

Aviator

Gates of Olympus

Booming Fruits 243

Big Bamboo

The Dog House Megaways

The Dog House

Sugar Rush

Fruit Party

Sweet Bonanza

Book of Aztec

Book of Ra

Асортимент представлених в закладі ігрових автоматів налічує понад 6000 різноманітних і яскравих емуляторів. Серед них користувачі зможуть знайти слоти будь-яких тематичних жанрів і з безліччю додаткових функцій. У закладі широко представлені як класичні карткові автомати, так і анімалістичні, вестерни, чарівні, містичні, пригодницькі, мультяшні, а також слоти з героями улюблених фільмів і телесеріалів. Весь азартний софт поставляється розробниками, які вже встигли проявити себе в гральній індустрії:

- Nolimit;

- Igrosoft;

- Greentube;

- Relax Gaming;

- Quickspin.

І іншими, не менш відомими провайдерами. В цілому, казино співпрацює з понад 50 компаніями, що спеціалізуються на розробці азартного софта. Що стосується додаткових функцій емуляторів, то користувачі з легкістю зможуть знайти собі автомат на будь-який смак: і з додатковими бонусними іграми, і з функцією джек-пот, і з ризик-грою, і навіть з накопичувальною системою різних бонусів.

Розділ з ігровими автоматами – найширший, але далеко не єдиний ігровий розділ в казино. Клієнти закладу можуть також грати в карткові та настільні ігри, обертати дзига рулетки, брати участь в лотереях і всіляких розіграшах. Для користувачів, які хочуть відчути себе відвідувача справжнього ігрового залу, в клубі передбачені столи зі справжніми професійними круп’є.

Завантажити Казино Пінап на Андроід

Сервіс закладу передбачає також можливість гри з мобільних пристроїв і планшетних комп’ютерів. Користувачі пристроїв на ОС Android можуть завантажити з офіційного сайту казино спеціальний додаток. Мобільний софт забезпечує максимально комфортні умови гри і враховує всі особливості операційної системи пристрою. Завдяки чому програма має безліч переваг:

- Мінімізований інтерфейс, призначений спеціально для гри з невеликих екранів.

- Займає не більше 40 Мб внутрішньої пам’яті.

- Не вимагає постійної авторизації в системі.

- Знижений споживання трафіку.

- Забезпечує швидке з’єднання з сервісом казино.

Адаптивна версія для користувачів iOS вже доступна в App Store. Посилання є і на сайті казино.

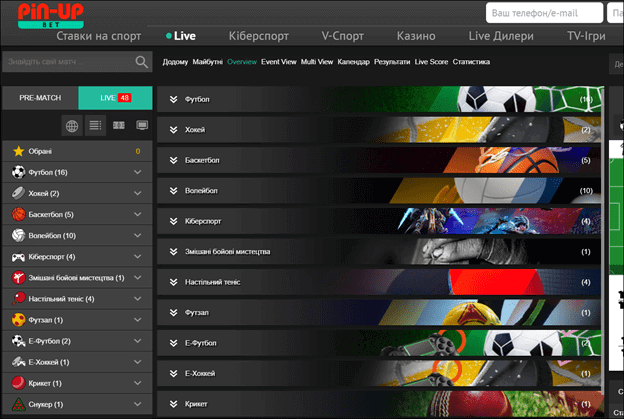

Pin Up Bet - Ставки на спорт онлайн

Наразі букмекерської лінії в української версії Пін Ап немає. Але є у міжнародної версії Pin Up, яка приймає спортивні парі в рамках понад 30 спортивних дисциплін. В першу чергу, це високий рівень коефіцієнтів і знижена букмекерська маржа на популярні події зі світу спорту. А також маса інших переваг, які відсутні у більшості букмекерів:

- Широка кіберспортивного лінія, яка не поступається розписом і асортиментом подій профільним кіберспортивного БК.

- Наявність інформаційних розділів «Статистика» та «Результати» для аналізу майбутніх матчів.

- Можливість перегляду прямих ефір більшості подій в LIVE-режимі.

- Наявність додаткових унікальних опцій: конструктор ставок, чек-редакт.

Більше інформації про букмекерській лінії сервісу Pin Up Bet UA можна знайти тут, де більш детально описані особливості спортивних ставок і всі переваги букмекера.

Реєстрація на офіційному сайті Pin-Up Casino

Відкрити рахунок у гральному закладі можна 2 способами: через email і номер мобільного телефону. Користувачам буде потрібно:

- Натиснути на кнопку «Реєстрація».

- Вибрати спосіб реєстрації.

- Ввести номер телефону / email і пароль.

- Погодитися з правилами гри в казино і натиснути «Зареєструватися».

Після реєстрації, клієнтам також необхідно буде заповнити анкету в Особистому кабінеті, в іншому випадку вони не зможуть пройти верифікацію облікового запису.

Верифікація в PIN-UP.UA є обов’язковою процедурою. Після входу в PIN-UP.UA перейдіть у вкладку “Профіль”, та натисніть “Пройти верифікацію”. Далі слід вибрати один із трьох методів:

1. Верифікація через застосунок ДІЯ.

2. Верифікація за Bank ID.

3 Надання документів, які підтверджують особу (внутрішній або закордонний паспорт громадянина України, ID-картка.)

Після успішного проходження цієї процедури можна робити ставки та подавати заявку на вивід коштів. У разі виникнення будь-яких проблем під час верифікації, слід звернутися до служби підтримки. Процедура верифікації необхідна, щоб запобігти користування ігровим сервісом неповнолітніми, а також з метою перешкоди відмиванню грошей і фінансуванню терористичних організацій.

Реєстрація через додаток Пинап Казино

Процедура реєстрації облікового запису в казіно нічим не відрізняється від процедури відкриття рахунку в десктопній версії сайту. Вся різниця в мінімізації графічних елементів та адаптації сайту для мобільних пристроїв. Користувачам доступні ті ж способи реєстрації акаунта:

- За номером мобільного телефону.

- За адресою електронної пошти.

Щоб відкрити рахунок, необхідно відкрити в додатку бокове меню, натиснути кнопку «Реєстрація» і заповнити анкету.

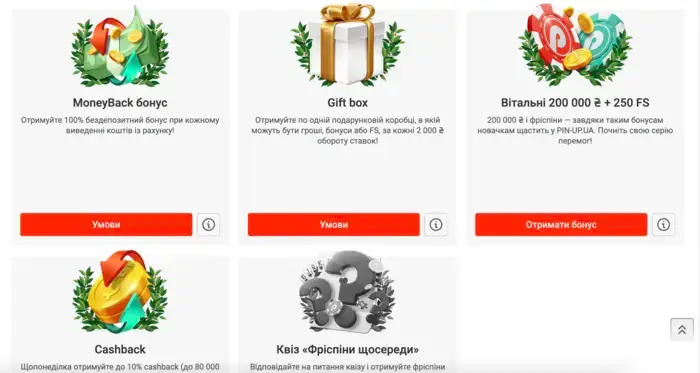

Пінап казино: бонуси та акції

Казино має репутацію самого лояльного закладу, оскільки надає своїй аудиторії величезне число всіляких бонусів. З їх допомогою новачки зможуть швидше освоїтися на сайті клубу, а професіонали зможуть отримати додатковий прибуток.

На сьогоднішній день адміністрація Пін Ап робить клієнтам:

- Бонус на перший депозит у розмірі 200 000 ₴.

- Щотижневе повернення частини програних коштів (до 10%).

- 250 фріспінів за перше поповнення рахунку.

- За кожні 2 000 ₴ обороту ставок отримуйте цінні призи від Pin Up UA! Це можуть гроші, бонуси або фріспіни.

Поповнення рахунку в гривнях та виведення коштів PinAp

Поповнити ігровий баланс можна через банківські карти, через

50 грн для EasyPay та City24, максимальний – залежить від платіжного засобу.

Депозити Pinup надходять на рахунок миттєво і без будь-яких комісій з боку адміністрації закладу. Висплата можлива тільки після успішного проходження процедури верифікації та тільки тим способом, який використовувався для здійснення депозиту.

Відгуки гравців України про PinUp

Користувачі часто залишають відгуки на різних тематичних ресурсах у мережі. Більша частина коментарів присвячена швидким виплатам в казино і великій варіативності платіжних систем для здійснення фінансових операцій. Також реальні клієнти закладу регулярно відзначають широкий ігровий асортимент і наявність зручного мобільного застосування.

Support Pin Up Казино - служба підтримки

Служба технічної підтримки Пин Ап приймає звернення клієнтів в цілодобовому режимі. Клієнти клубу можуть поставити своє питання в чаті на сайті казино, телефоном або замовивши зворотній дзвінок.

FAQ

Щоб битися об заклад реальними грошима, необхідно зареєструватися на сайті казино і поповнити ігровий баланс. Велика частина азартних ігор також доступна клієнтам закладу і в демонстраційному режимі.

Щоб грати на гривні та поповнювати в гривнях рахунок, необхідно зареєструватися на сайті. Внести кошти можна за допомогою VISA, Mastercard, GPay, Apple Pay, EasyPay, Сity24.

Виплата можлива на картки VISA, Mastercard. Оформити заявку на виплату можна в особистому кабінеті після успішного проходження процедури верифікації ігрового акаунта. Від користувача потрібно вибрати спосіб виведення, вказати суму і підтвердити оформлення заявки. Кошти надійдуть на рахунок миттєво.

ПінАп онлайн-казино - перевага у кожній деталі!

Жадаєте великого виграшу? Йдіть до великої перемоги дрібними кроками! Спеціально для Вас було розроблено альтернативну валюту Pincoins! Виконуйте прості місії на 100% і отримуйте можливість обміняти накопичені Pincoins на РЕАЛЬНІ ГРОШІ та дуже цікаві призи. Не бійтеся, що подарунки Вам набриднуть, цього не станеться! Список оригінальних завдань і призів дуже швидко поповнюється, тому нам завжди є чим Вас порадувати! Список ігрових автоматів оновлюється щодня, і головне завжди свіжі слоти. При цьому ви не просто будете брати участь, але і отримувати за кожну дію бонус. До зробленого першого депозиту ми нарахуємо + 400% бонусних коштів. Pin-up казино-онлайн це двомовна платформа, що підтримує українську та російську мови. Грайте, вигравайте і насолоджуйтеся яскравими образами карколомних дівчат! Ми приготували для Вас ексклюзивний формат, то спробуйте його!

варіанти назви казино:

пін ап, пінап, pin-up, pin ap, pinap, пин-ап, пінуп, пін уп

Насколько публикация полезна?

Нажмите на звезду, чтобы оценить!

Средняя оценка 3.3 / 5. Количество оценок: 23

Оценок пока нет. Поставьте оценку первым.